Impact of State Legislation on ESOP Creation

Does State legislation have an impact on ESOP creation?

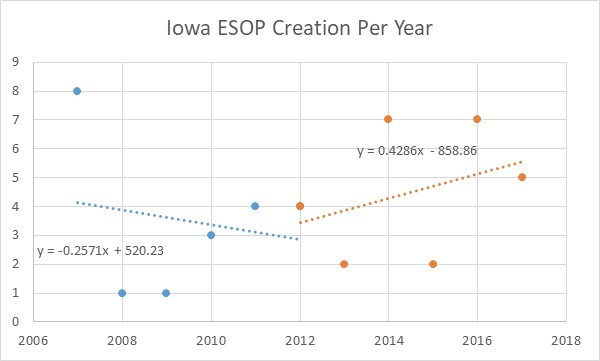

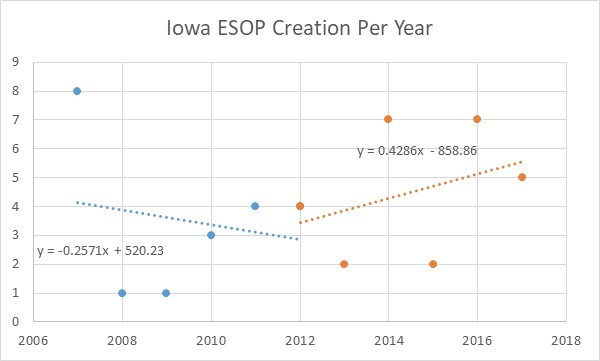

In 2012 Iowa, House File 2465, was signed into law on May 25. This bill exempts 50% of the net income from taxation if a company is sold to an ESOP that owns at least 30% of the stock. A review of the 2017 DOL data would suggest that ESOP creation in Iowa increased after 2012.

As you can see from the above graphic there is a negative trend in ESOP creation prior to 2012 (y=-0.26X+520) and a positive trend in ESOP creation post 2012 y=0.453x-859). While this data looks promising, there could be any number of reasons why ESOP creation increased from 2012-2017. To gain a better understanding of the impact of HF 2465 on Iowa ESOP creation, the Indiana Center for Employee Ownership is currently performing research with the 27 Iowa companies that transitioned to an ESOP between 2012 to 2017. The main goal of this research is to understand to what impact HF 2465 had on the company’s decision to transition to an ESOP.

If the research does identify that HF 2465 was a significant positive influencer to transition company ownership to ESOPs, INCEO will share this information with other state centers for employee ownership and members of the Indiana State Legislature. Ultimately INCEO’s goal is to introduce similar legislation to encourage and support conversion of privately held businesses to an employee ownership structure such as an ESOP.

Stay tuned for updates on this key research.

Rick